Depreciation expense formula

450 divided by three three years of expected useful life of the printer 150. 150 is the expected annual straight-line depreciation expense of the new printer.

Depreciation Expense Double Entry Bookkeeping

The periodic depreciation is charged to the income statement as an expense according to the matching principle.

. How Depreciation Expense is Calculate by using straight line method. How Bonus Depreciation Works. To find the monthly accumulated depreciation using the above example convert the annual depreciation into months by dividing by 12.

Depreciation cost - salvage value years of useful life. For tax years 2015 through 2017 first-year bonus depreciation was set at 50. Once you have the yearly accumulated depreciation you can also calculate depreciation by month quarter or another fiscal time period.

Let have a look at the formula so you can understand it better. Double-Declining Method Depreciation Double-Declining Depreciation Formula To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life. The basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement depreciation and the other is a contra.

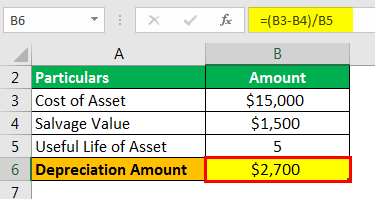

Company X buys equipment for Rs7000 and the useful life of the machinery is 5 years and the Salvage value of the machinery is Rs4000. GAAP depreciation is a way of spreading the expense of an asset over the number of years that the asset will be in service for the business. Divide annual depreciation to get monthly depreciation.

The business uses the following formula to calculate the straight-line depreciation of the printer. The effect of a tax shield can be determined using a formula. It is computed by deducting OPEX such as salaries depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

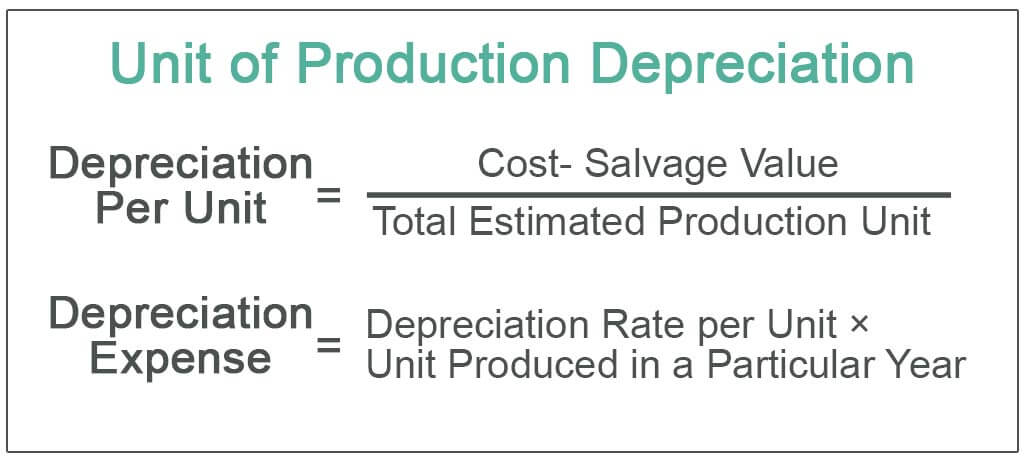

As the name suggests the expense is calculated on a straight line. Depreciation Expense 4 2 -Unit of Production Method. Further it also offers a tax.

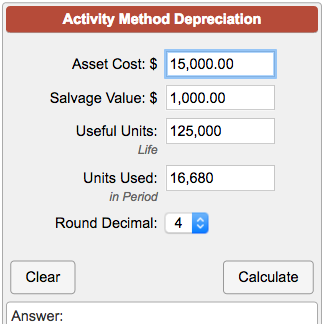

Depreciation Expense Cost of Asset-Residual Value Estimated life of Asset. In other words the value of the annual depreciation is the portion of the fixed asset that has been used in revenue generation during the year. Net book value - salvage.

Using bonus depreciation you can deduct a certain percentage of the cost of an asset in the first year it was purchased and the remaining cost can be deducted over several years using regular depreciation or Section 179 expensing. Price of acquiring the printer 500 - approximate salvage value 50 450. This ratio is more useful in the real estate industry.

It is operating expenses. Depreciation Expense 2000 5. Lets look at OER from that perspective.

Depreciation Expense Rs. Depreciation Expense 5000 3000 5. In this ratio there are two components.

Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving. The first component is the most important one. 100000 and the expected usage of the truck are 5 years the business might depreciate the asset under depreciation expense as Rs.

How to calculate depreciation in small businesses. Depreciation Formula Table of Contents Formula. According to the IRS restaurant owners can calculate depreciation expense using the 200 percent declining balance method the 150 percent declining balance method or the straight-line method.

The formula looks like this. Four methods of depreciation are permitted under GAAP. Calculating Depreciation Using the 150.

Totally there are 20 Units of equipment. The straight line method declining balance units of production and sum of years digits. Depreciation expense is the cost of an asset that has been depreciated for a single period and.

11250 12 about. The straight-line depreciation formula is. Operating Expense Formula Sales commission Rent Utilities Depreciation 10 5 5 8 million.

First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate. This is usually the deduction multiplied by the tax rate. Two methods are again used to record depreciation.

20000 every year for a period of 5 years. An example of Depreciation If a delivery truck is purchased by a company with a cost of Rs. To increase cash flows and to further increase the value of a business tax shields are used.

Depreciation is an accounting method that spreads out the cost of an asset over its useful life.

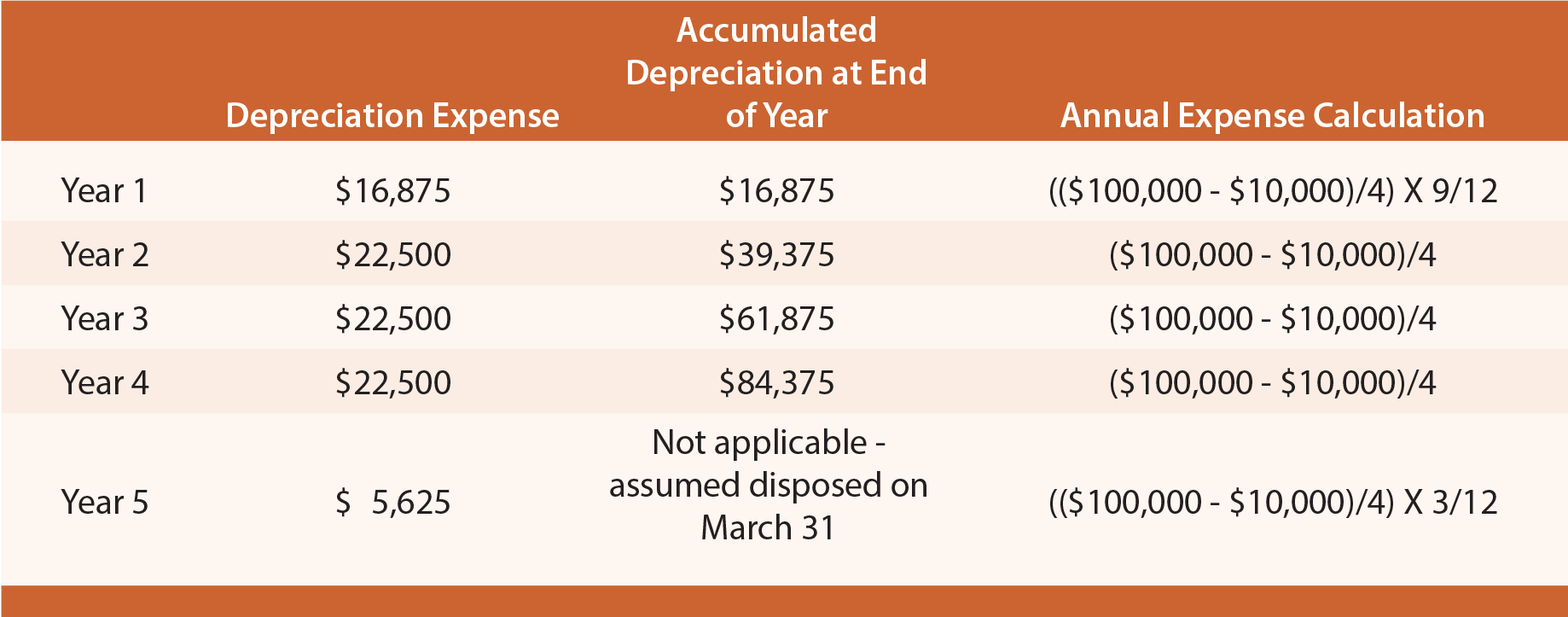

Accumulated Depreciation Definition Formula Calculation

Unit Of Production Depreciation Method Formula Examples

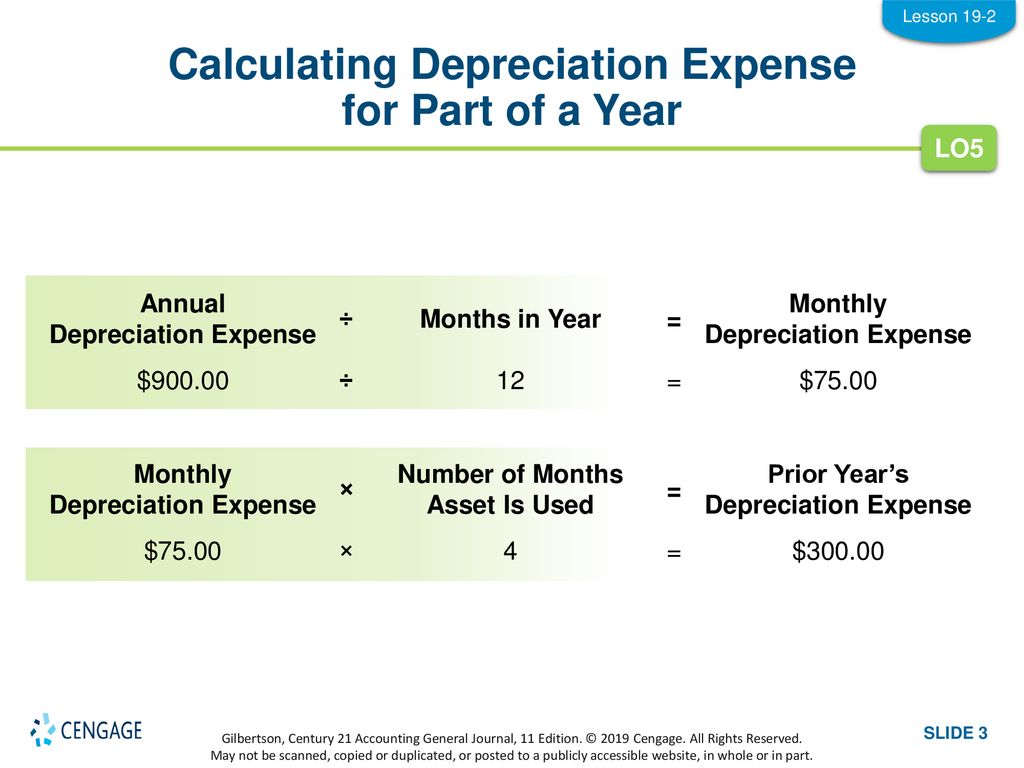

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Depreciation Calculation

Depreciation Calculator Shop 58 Off Www Wtashows Com

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner

What Is Accumulated Depreciation How It Works And Why You Need It

How To Calculate Depreciation Expense

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation

/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)

Accumulated Depreciation And Depreciation Expense

How To Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Accumulated Depreciation Definition Overview How It Works